SDG 11 - Sustainable Cities

SDG 11 - Sustainable Cities

Rapid Own Source

Revenue Analysis

An evidence-based, quantitative decision-making tool for local finance practitioners seeking to optimize own-source revenues (OSRs) in developing cities and subnational governments.

What is the ROSRA?

ROSRA stands for:

ROSRA is a UN-Habitat diagnostic tool that helps local governments see where their own source revenue (OSR) system stands today and how much room there is to improve under current legislation.

Using a quantitative approach, it estimates actual OSR gaps and shows how much revenue is being left untapped, helping mobilize political support for reforms.

Strategic Decision Making

Clear visualization of OSR gaps for informed decisions

Reform Prioritization

Prioritize interventions and allocate resources effectively

Enhanced Creditworthiness

Strengthen municipal finance foundations

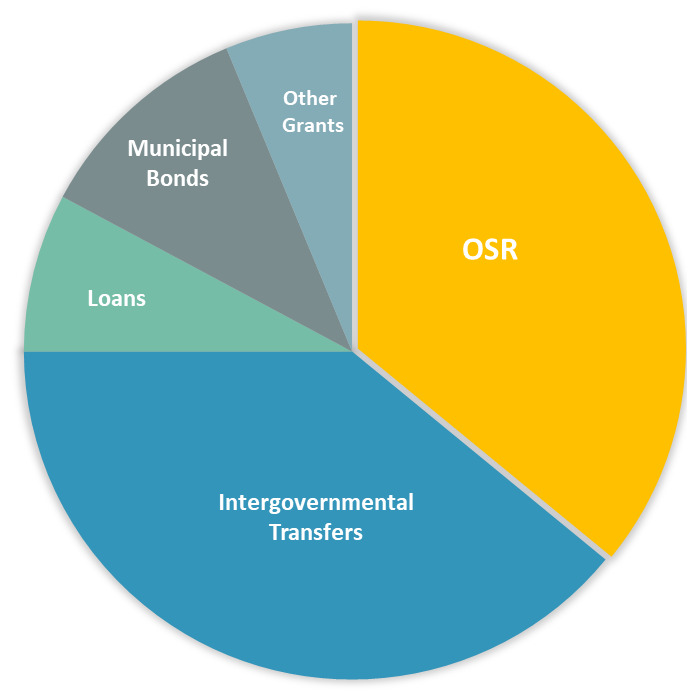

What is Own Source Revenue (OSR)?

OSR is one of several revenues of local governments

OSRs are taxes, fees, licenses, etc. directly controlled by local governments

Property Tax

Recurrent tax on land or property

Other Taxes

Local Sales Tax, Excise Tax, Hotel Tax, Vehicle Tax

User Fees

Parking, Road Tolls, Market Fees, Transit

Licenses & Permits

Business Permit, Liquor License, Health License

Fines & Penalties

Parking Fines, Late Payment Fees

Revenue from Assets

Public Land, Buildings, Investments

Why Optimize OSR?

Increases Resources

Close unfunded mandates, maintain infrastructure and invest in development.

Increases Autonomy

Reduce dependence on inter-governmental transfers (IGT) to cover expenditure needs.

Strengthens Social Contract

When collecting taxes and fees, governments become more accountable to constituents.

Improves Capacity

Improvements in accounting, procurement, technology and auditing practices.

Enables Leveraging

Impact economic growth, income distribution, and correct market failures.

Increases Creditworthiness

Creditors assess debt repayment likelihood based on local revenue generation.

Who is the ROSRA for?

The ROSRA was designed primarily for government officials in local governments in low-income and fragile state contexts.

It can also be used by non-governmental partners with access to revenue related data of local governments.

Secondary Cities

Better suited for secondary cities rather than very large urban metropoles

Senior Management

Functions best when supported by senior management with technical staff input

Land-Based Finance

Particularly helpful where land-based finance systems are present at the local level

How does the ROSRA work?

Analysis Process

The ROSRA analyses user data by comparing it with accepted benchmarks and the specific characteristics of well-functioning OSR systems observed in peer local governments.

Authority & Incentives

The authority and incentives of local government to raise OSR

Capacity Assessment

The capacity and incentives of the revenue administration

Strategy & Management

The strategy, management and collection processes

Required Input Data

Socio-economic data

GDP, population statistics

Budget data

Revenue and OSR data from past financial year

Management data

OSR environment, management and administration details

Data Privacy

Only visible to the local government itself

UN-Habitat will only use data after gaining explicit formal permission

All data input into the ROSRA is completely confidential

What People Are Saying

"The ROSRA shows us that we have essentially been doing everything wrong in regard to OSR"

"This is the most accurate analysis of our OSR system that we have received until now and it is spot on"

"I am not aware that such a tool exists, and it is quite needed to support local governments in optimizing their OSR"

"This tool adopts an interesting and promising methodology to support local governments in the critical area of OSR"

Why Choose UN-Habitat?

Data

We bring the best of global data paired with exemplary analysis to provide the most tailored and effective recommendations.

Experience & Expertise

Global experience on municipal finance issues in many countries and contexts. Our network of experts bring extensive knowledge.

Funds Mobilization

When supported by a UN agency, it becomes easier to mobilize funding from other sources.

Political Weight

The UN name provides credibility and political stature to act on recommendations.

City photographs from Unsplash (free to use) | SDG icons © United Nations | Icons by Font Awesome